Description

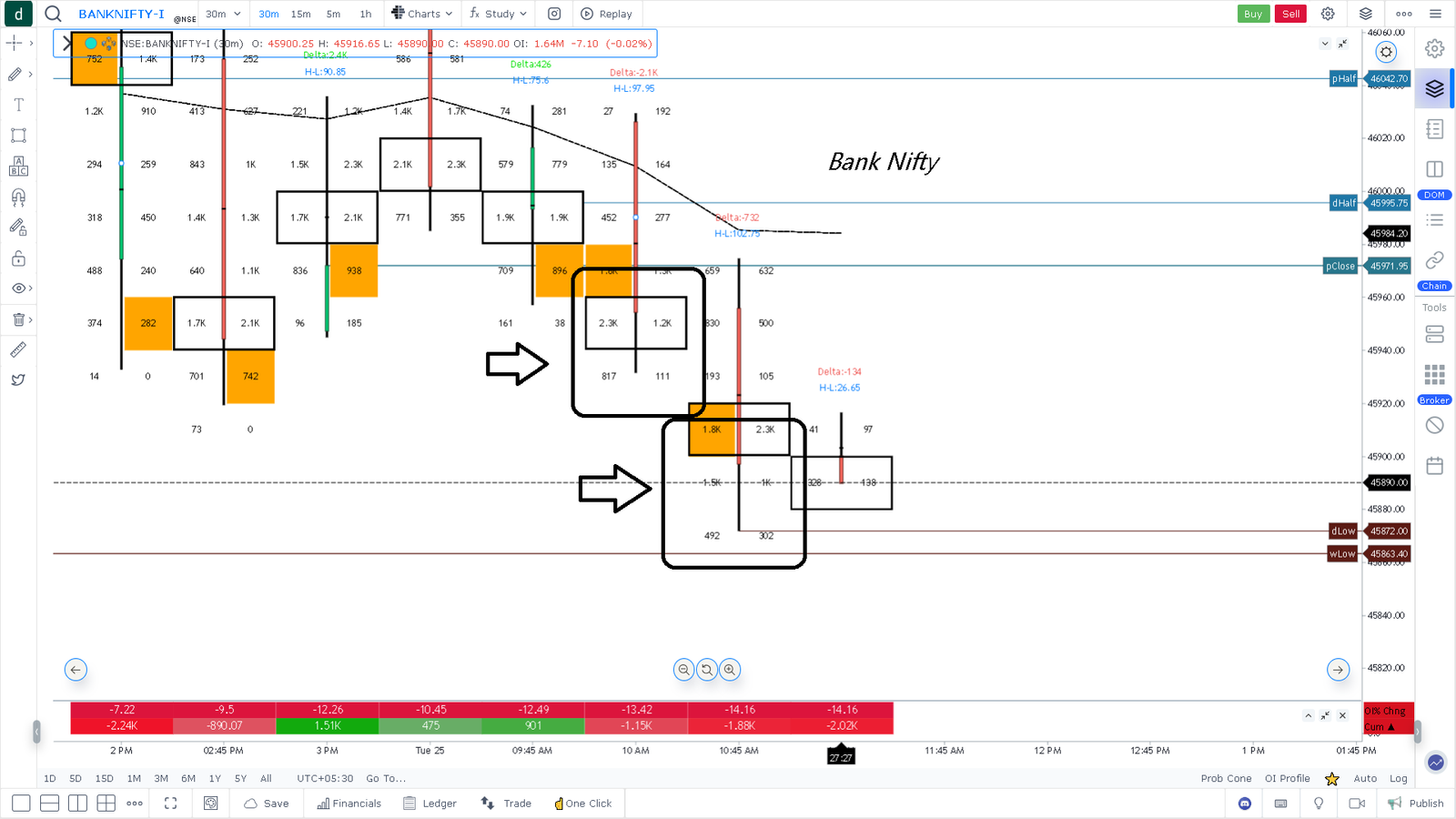

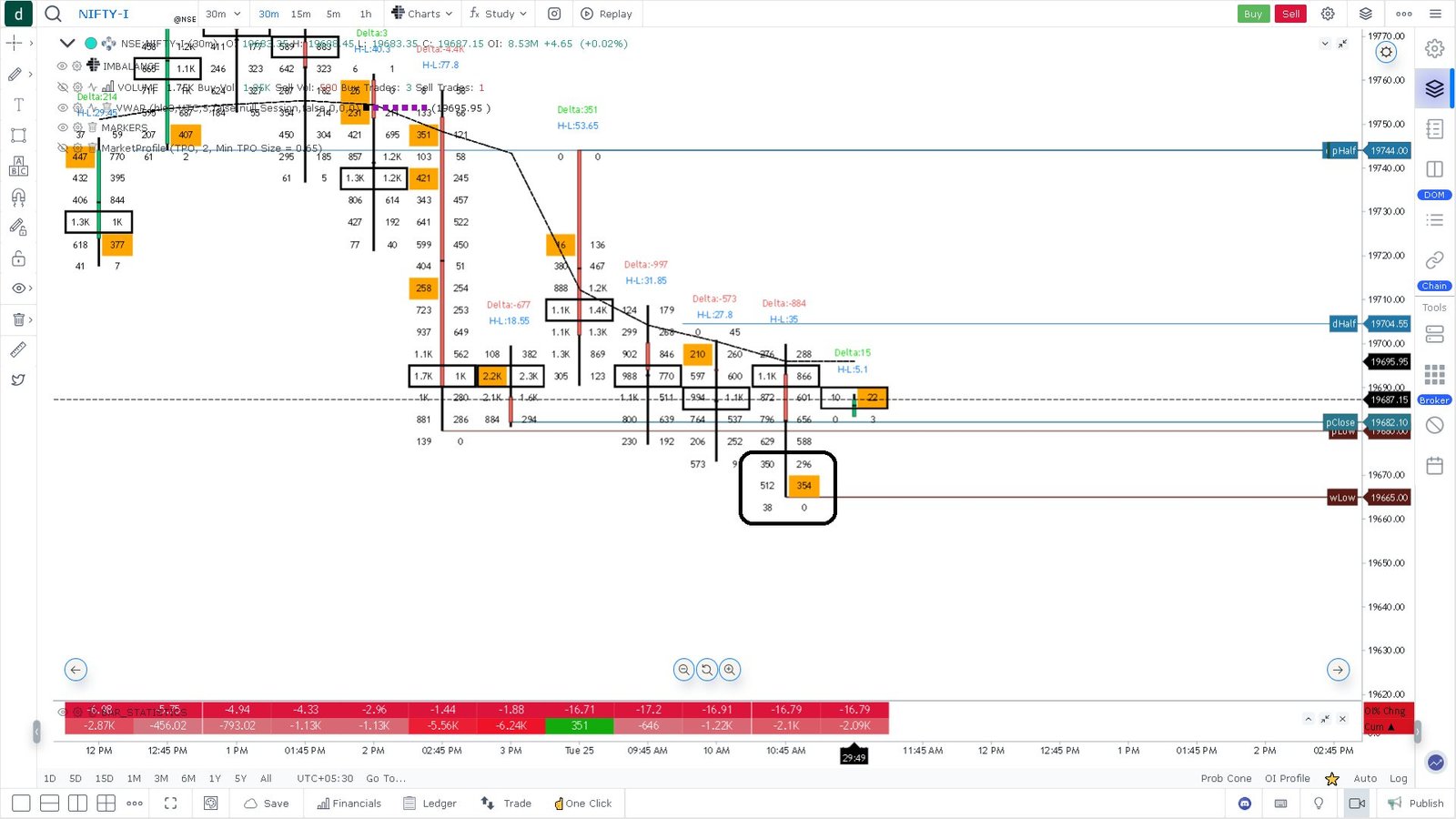

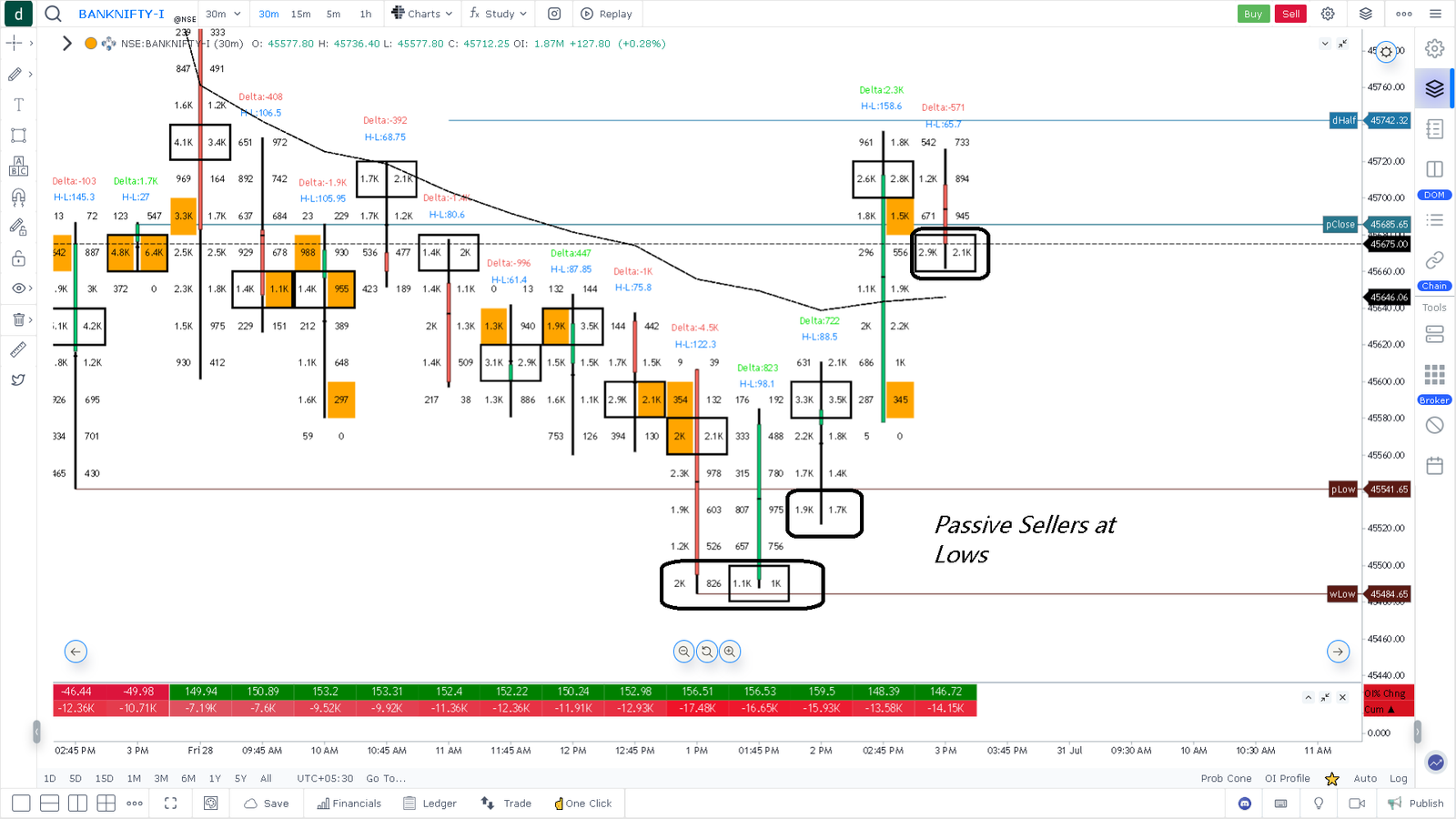

Navigating the intricate world of global stock trading requires both intuition and a robust strategy. This project delves into the heart of world stock indices, harnessing a multitude of proven trading strategies to decipher patterns, insights, and potential profit avenues. With tools such as moving averages, candlestick patterns, and the advanced capabilities of TradingView's strategy functions and Pine Tester, the objective is to decode the stock trading landscape and introduce methodical, data-driven decision-making.

Key Features

- Advanced Tools:-

- Diverse Strategies:-

- In-depth Metrics:-

- Detailed Analysis:-

- Objective:-

Leveraging the power of TradingView strategy functions and Pine Tester to simulate, backtest, and refine trading strategies on global stock indices.

From moving averages to the complexities of candlestick patterns, a myriad of strategies are meticulously tested and implemented.

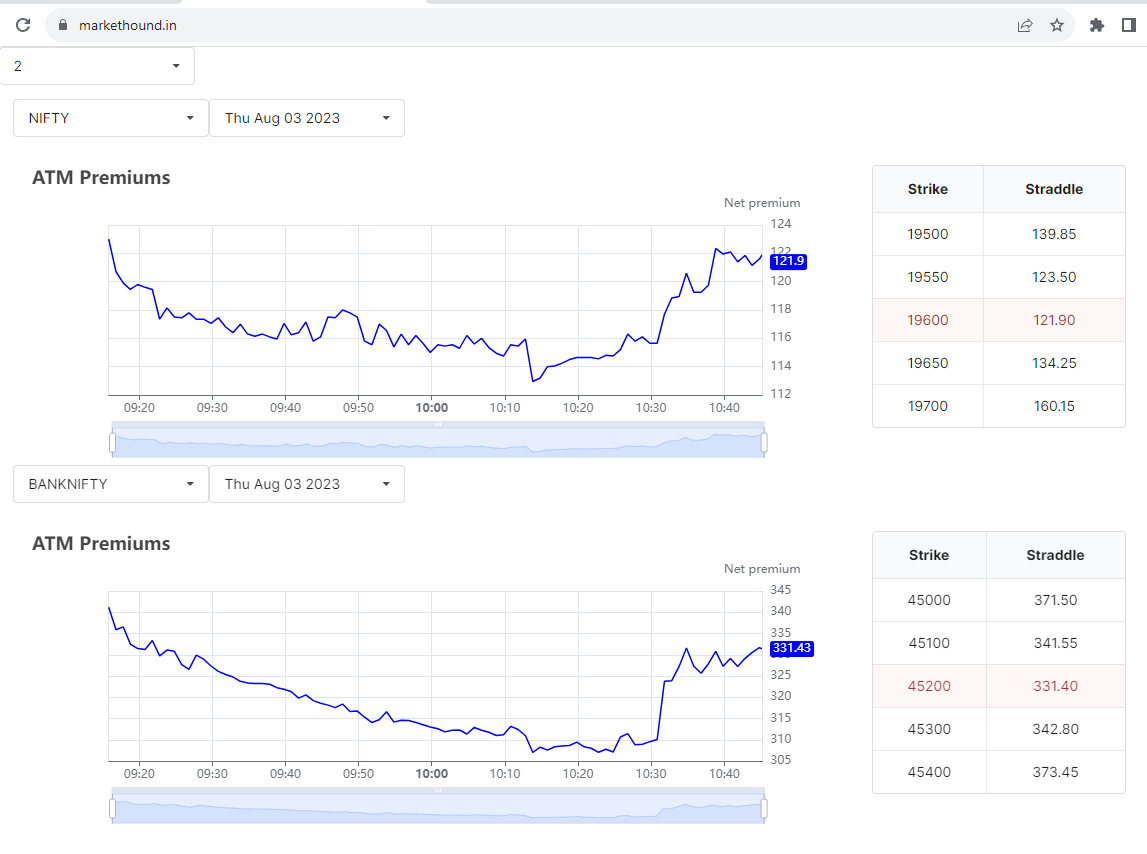

Beyond just strategy application, delve into metrics like net profit, gross profit and loss, total trades, and more, offering a comprehensive performance overview.

Uncover insights with metrics such as profit factor, max drawdowns, average winners versus losers, and other critical data points.

In the unpredictable realm of stock markets, a data-driven approach sets the foundation for success. This project aspires to equip traders with empirical, actionable insights, fostering informed decision-making. Through the analysis of global stock indices using varied strategies and advanced tools, traders are presented with a nuanced understanding of potential risks and rewards.

TradingView

TradingView Website Go To